What The Federal Interest Rate Change Means For Small Business

In addition to the decisions and strategies implemented by a small business, there are also external factors that impact the financial decisions of small business owners. One the more significant factors is the current interest rate and the actions of the U.S. Federal Reserve to determine interest rate change.

The Federal Reserve chose not increase their rate during the Federal Open Market Committee meetings on March 15th and 16th 2016. The Federal Open Market Committee is the Federal Reserve’s policy-making committee. The committee meets again in April and then in June. However, analysts and investors do not expect another interest rate change until June 2016.

The plan, however, was originally for the Committee to raise its benchmark rate about one percentage point, most likely in four quarter-point increments. But federal officials delayed those plans after financial conditions tightened in January because of concerns about the health of the global economy.

The move went over well with investors. When the Fed made its announcement that there would be no interest rate change, the Standard & Poor’s 500-stock index rose sharply and closed up 0.56 percent for the day. After a rough start to the year, the major stock gauges had almost recovered their losses.

The Federal Reserve and Small Business

The Federal Reserve, or the “Fed” as it’s commonly called, impacts how much currency is in circulation, any interest rate change for institutions lending money, and is responsible for controlling the country’s monetary policy.

One of the main ways the Fed maintain its monetary policy is their benchmark short-term interest rate. This rate ultimately impacts everything from the price of groceries cost to the ability for businesses to hire new employees. Any increase or decrease in this rate inevitably spurs a subsequent interest rate change across the board.

Why is this?

Because high interest rates means it costs businesses more to borrow capital, while low interest rates make it cost less. At the height of the Great Recession, the Fed lowered its interest rate to near zero for the first time in U.S. history.

The Federal Open Market Committee did this in response to the fact that credit had dried up, and they hoped to spur bank lending to stimulate the economy. It took a long time for some semblance of economic recovery to come about and, during this time, interest rates have stayed at 0.0-0.25 percent.

The Fed kept its own interest rates at this level from December 2008 until December 2015 when it made an interest rate change from 0.0-0.25 percent up to 0.25-0.5 percent. During this seven-year period of near-zero rates, a large number of small businesses opened and closed their doors, while many entrepreneurs launched new enterprises and the economy slowly improved.

How Does This Benefit Small Businesses?

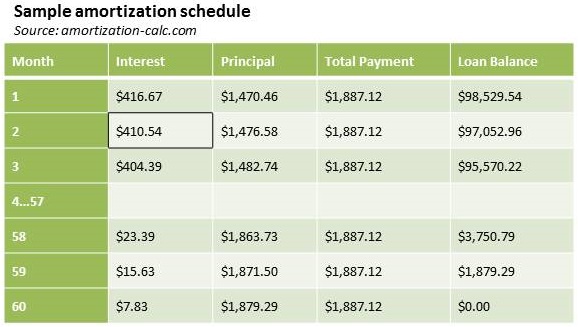

As previously noted, when an interest rate change results in an increase in rates, capital becomes more expensive, which means those owners looking for a small business loan may end up paying more in the long run.

However, many alternative lenders such as online lenders are not bound by this rate the same way traditional banks are. This can provide many more options for small business owners looking to access capital.

According to some analysts the decision not to hike rates could bring additional economic woes. However, despite some uncertainty in certain sectors regarding the central bank’s decisions, the bottom line is that small businesses can benefit from pursuing a working capital loan if necessary.