How To Calculate Business Loan Fees

If you’re starting a business or looking to grow your existing business, a small business loan may be a viable financial strategy. Keep in mind that when you repay a small business loan, however, you’ll end up paying more than the amount borrowed because of interest, amortization, and business loan fees.

All small business loans come with interest that the borrower pays to the lender and loan rates can be varied or fixed.

Variable rates change over time as market interest rates shift. If market rates are high, a variable rate can be a good idea since the loan rate will decrease if market interest rates drop.

Fixed rates lock in the market interest rate at the time a borrower takes out the loan. If market rates are low, it’s wise to get a fixed rate and maintain that low interest rate throughout the duration of the payment schedule.

Understanding Amortization

The loan’s term, or how long it takes to pay off, affects the overall cost of the loan because it determines how long interest is paid. This is known as amortization which can be defined as the gradual repayment of a loan in equal (or nearly equal) installments which include portions of interest and principal amounts.

Although interest is not typically considered in the same category as business loan fees, it is still part of your cost for borrowing a sum of money. Calculating your amortized interest payments is done with a payment, or amortization schedule. This is a plan for paying back a loan in regular monthly increments.

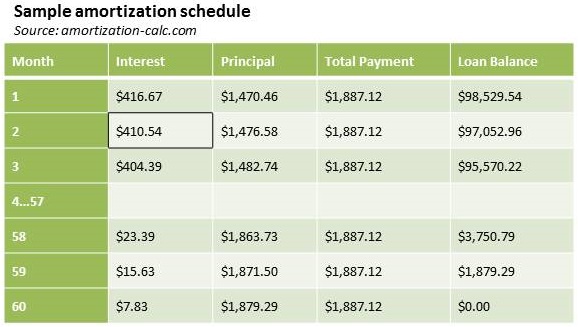

Each payment consists of principal and interest. For example, assume you have taken out a $100,000 loan for five years with a 5% interest rate. Each month, you’ll repay $1,887.12 in principal and interest.

At the beginning of the term, the larger portion of your payment is interest. Consequently, $416.67 of your first payment is interest and $1,470.46 goes towards the principal.

With each payment, the interest portion decreases and the principal payment increases. In our example the interest amount has decreased by $6.13 on the second payment and the principal portion increased accordingly:

In the final month, you would only pay $7.83 in interest and $1,879.29 in principal to pay off the loan.

Looking at Other Typical Business Loan Fees

As a borrower you will also have to pay business loan fees. Most common are origination and guarantee fees, but some lenders will have additional costs. Often you will have to pay interest on any fees that are added to the loan rate. This increases not only the amount loaned, but the total interest charged as well.

Origination fee – An upfront fee that is charged for processing a new loan. Lenders charge borrowers this fee for processing a loan application and other administrative work involved. It’s taken as a percentage of the total loan, for example, 1% of a $100,000 loan.

Guarantee fee – For SBA-guaranteed loans, lenders pay the government a portion of the amount guaranteed. Many lenders pass on part of this cost to the borrower.

Underwriting fees – These are business loan fees collected by underwriters who verify and review all of the information you’ve provided.

Closing costs – These business loan fees can include other costs associated with servicing the loan such as a loan-packaging fee, a commercial real estate appraisal or a business valuation.

Unfortunately, business loan fees are unavoidable and can add a significant amount of money to your loan. Each lender should give you a list of what each fee includes and should explain any fees that you don’t understand.